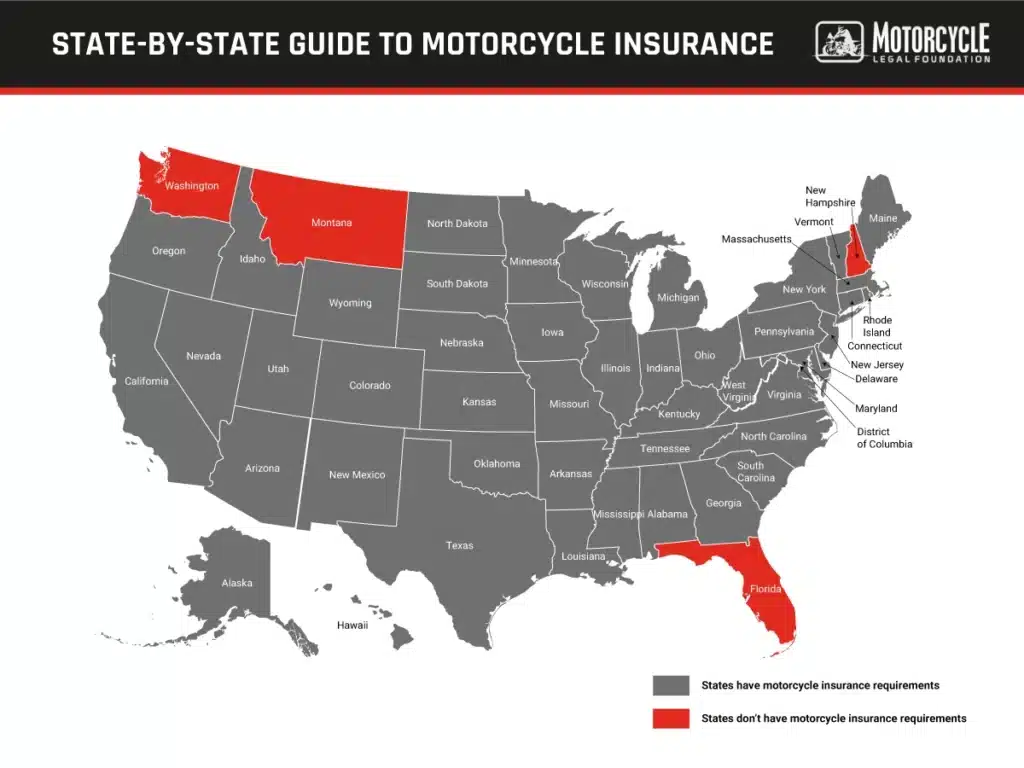

Only four states, Florida, Montana, New Hampshire, and Washington, do not have mandatory motorcycle insurance requirements. The other 46 states and the District of Columbia require that you at least have bodily injury and property damage coverage to register and ride a motorcycle. The truth is that carrying motorcycle insurance is a good idea regardless of where you ride.

If someone is injured or incurs property damage in an accident that you caused, a motorcycle insurance policy pays for an attorney to defend you and pays claims up to the coverage limits. Even if you live in a state that does not have motorcycle insurance requirements, purchasing a policy offers peace of mind.

Keeping track of motorcycle insurance requirements can be challenging, particularly if your rides take you away across state borders. This guide gives you the latest information about insurance requirements in each state and explains the different types of mandatory and optional coverages you may wish to consider purchasing. Just keep in mind that laws change, so it’s wise to check a state’s motor vehicle department to determine if there have been any recent changes in its motorcycle insurance requirements.

Need Motorcycle Insurance?

Enjoy your ride while feeling safe with the best insurance coverage.

Motorcycle Insurance Basics

Motorcycle insurance and automobile insurance are similar. You pay a premium to an insurance company in exchange for it issuing an insurance policy with coverages offering financial protection in case of an accident or other mishap.

You choose the scope of the protection by selecting from coverage options offered by the insurer. For example, the commonly offered types of coverages available in a motorcycle insurance policy include the following:

- Liability Insurance: When an accident you cause when riding a motorcycle results in personal injuries to another person or damage to their property, liability insurance pays to defend against claims made against you and pay them up to the coverage limits. Bodily injury and property damage, the two components of liability insurance, are the coverages required in states with mandatory motorcycle insurance.

- Uninsured and Underinsured Motorist Coverage: When you suffer injuries in an accident caused by the negligence of another motorist who does not have liability insurance or does not have enough insurance, you can file a claim against your insurance company under the uninsured motorist coverage and underinsured motorist coverage. Some states, including Maryland, Missouri, and Wisconsin, require that you have this coverage as part of your motorcycle insurance policy.

- Collision Coverage: Collision is an optional coverage you add to your insurance policy that pays for repairing or replacing your motorcycle damaged in a crash, regardless of who was at fault.

- Comprehensive Coverage: Comprehensive pays for damage to your motorcycle or theft caused by events other than collisions, including fire, theft, vandalism, weather, and similar circumstances.

You decide on the amount of insurance to purchase. Just keep in mind that the more insurance coverage you get, the greater the cost of the policy. If you live in a state with minimum insurance requirements, you can purchase more than the mandatory minimum coverage.

The cost of motorcycle insurance depends on the type of coverage you select and the amount of coverage. Insurance companies also evaluate factors they know from analyzing accident and claim data affect the cost of a motorcycle insurance policy, including the following:

- Your age and riding experience: Riders between the ages of 15 and 20 and those 65 and older have higher rates of fatal crashes.

- Type of motorcycle: A motorcycle with a small engine and the latest safety features is less of an accident risk than a motorcycle with a powerful motor that does not have ABS and other safety features.

- Your driving record: A history of accidents and traffic violations probably means you’ll pay more for insurance than someone with a clean driving record.

- Where you live: According to the federal government, more fatal motorcycle crashes occur in urban areas than in rural communities, so if you live in a city, expect to pay more for insurance.

Obtaining price quotes from several companies is an excellent way to get the best rate for motorcycle insurance.

Is Motorcycle Insurance Required?

Florida, Montana, New Hampshire, and Washington are the only states where you can register a motorcycle and ride without insurance and not be in violation of the law. Florida, which does not require proof of insurance to register or ride a motorcycle, has a financial responsibility law.

The financial responsibility law means motorcycle riders involved in an accident in Florida must have the financial ability to pay claims made against them for property damage and bodily injuries resulting from an accident where they were at fault. The easiest way for a person to satisfy the financial responsibility requirement is with a liability insurance policy with at least $10,000 in bodily injury coverage for one person injured or killed in a crash and $20,000 of coverage per accident when two or more people are killed or injured.

Adding property damage coverage to the policy in the minimum amount of $10,000 ensures compliance with Florida law and avoids a three-year suspension of a person’s driver’s license. The statute allows you to self-insure by obtaining a certificate of financial responsibility from the state after proving you can pay claims made against you.

The motorcycle insurance requirements in the remaining 46 states and the District of Columbia have one thing in common. Each of them requires liability insurance and property damage coverage, but they differ in the amount of insurance and other coverage requirements.

States generally do not require medical payment coverage for motorcycles. Medical payments coverage, or MedPay, pays the medical expenses of riders and their passengers who suffer injuries in motorcycle accidents regardless of who was at fault.

However, if you ride a motorcycle in Michigan without a helmet, you must have $20,000 in MedPay coverage to comply with the law. The coverage is not required if you and your passenger wear helmets, but adding it to a motorcycle insurance policy could protect you against financial disaster caused by the high cost of medical treatment after a crash.

State-By-State Motorcycle Insurance Guide

The following guide gives you each state’s motorcycle insurance requirements. Keep in mind that most states have different requirements for motorcycles than for other types of motor vehicles.

For example, Florida is a no-fault state, so drivers must have personal injury protection (PIP) coverage through an insurance company. A person injured in a car accident submits their claim for payment of medical bills to PIP insurer instead of making a claim against another driver. However, Florida does not require PIP coverage for motorcycles, so do not assume that a state’s insurance requirements for cars apply to motorcycles.

As you read the guide, liability insurance requirements are shown as three numbers separated by slashes. For example, 20/40/15 means a state requires motorcycles to have $20,000 in bodily injury coverage per person, $40,000 in bodily injury coverage per accident for two or more persons, and $15,000 in property damage coverage per accident.

Northeast Region

- Connecticut

- Is Motorcycle Insurance Required in Connecticut? Yes.

- Motorcycle Insurance Requirements in Connecticut: 25/50/25.

- Delaware

- Is Motorcycle Insurance Required in Delaware: Yes.

- Motorcycle Insurance Requirements in Delaware: 25/50/10.

- Personal injury protection (PIP) required: $15,000 per person and $30,000 maximum per accident.

- Maine

- Is Motorcycle Insurance Required in Maine? Yes.

- Motorcycle Insurance Requirements in Maine: 50/100/25.

- Massachusetts

- Is Motorcycle Insurance Required in Massachusetts? Yes.

- Motorcycle Insurance Requirements in Massachusetts: 20/40/5.

- New Hampshire

- Is Motorcycle Insurance Required in New Hampshire? No.

- Motorcycle Insurance Recommended in New Hampshire: 25/50/25.

- New Jersey

- Is Motorcycle Insurance Required in New Jersey? Yes.

- Motorcycle Insurance Requirements in New Jersey: 15/30/5.

- New York

- Is Motorcycle Insurance Required in New York? Yes.

- Motorcycle Insurance Requirements in New York: 25/50/10.

- Pennsylvania

- Is Motorcycle Insurance Required in Pennsylvania? Yes.

- Motorcycle Insurance Requirements In Pennsylvania: 15/30/5.

- Rhode Island

- Is Motorcycle Insurance Required in Rhode Island? Yes.

- Motorcycle Insurance Requirements in Rhode Island: 25/50/25.

- Vermont

- Is Motorcycle Insurance Required in Vermont? Yes.

- Motorcycle Insurance Requirements in Vermont: 25/50/10.

Midwest Region

- Illinois

- Is Motorcycle Insurance Required in Illinois? Yes.

- Motorcycle Insurance Requirements in Illinois: 25/50/20.

- Indiana

- Is Motorcycle Insurance Required in Indiana? Yes.

- Motorcycle Insurance Requirements in Indiana: 25/50/25.

- Iowa

- Is Motorcycle Insurance Required in Iowa? Yes.

- Motorcycle Insurance Requirements in Iowa: 25/40/15.

- Kansas

- Is Motorcycle Insurance Required in Kansas? Yes.

- Motorcycle Insurance Requirements in Kansas: 25/50/25.

- Michigan

- Is Motorcycle Insurance Required in Michigan? Yes.

- Motorcycle Insurance Requirements in Michigan: 50/100/10

- $20,000 medical benefits coverage is required to ride without a helmet.

- Minnesota

- Is Motorcycle Insurance Required in Minnesota? Yes.

- Motorcycle Insurance Requirements in Minnesota: 30/60/10.

- Missouri

- Is Motorcycle Insurance Required in Missouri? Yes.

- Motorcycle Insurance Requirements in Missouri: 25/50/10.

- Nebraska

- Is Motorcycle Insurance Required in Nebraska? Yes.

- Motorcycle Insurance Requirements in Nebraska: 25/50/25.

- North Dakota

- Is Motorcycle Insurance Required in North Dakota? Yes.

- Motorcycle Insurance Requirements in North Dakota: 25/50/25.

- Ohio

- Is Motorcycle Insurance Required in Ohio? Yes.

- Motorcycle Insurance Requirements in Ohio: 25/50/25.

- Oklahoma

- Is Motorcycle Insurance Required in Oklahoma? Yes.

- Motorcycle Insurance Requirements in Oklahoma: 25/50/25.

- South Dakota

- Is Motorcycle Insurance Required in South Dakota? Yes.

- Motorcycle Insurance Requirements in South Dakota: 25/50/25.

- Wisconsin

- Is Motorcycle Insurance Required in Wisconsin? Yes.

- Motorcycle Insurance Requirements in Wisconsin: 25/50/10.

South Region

- Alabama

- Is Motorcycle Insurance Required in Alabama? Yes.

- Motorcycle Insurance Requirements in Alabama: 25/50/25.

- Arkansas

- Is Motorcycle Insurance Required in Arkansas? Yes.

- Motorcycle Insurance Requirements in Arkansas: 25/50/25.

- Georgia

- Is Motorcycle Insurance Required in Georgia? Yes.

- Motorcycle Insurance Requirements in Georgia: 25/50/25.

- Florida

- Is Motorcycle Insurance Required in Florida? No.

- Motorcycle Insurance Requirements in Florida: None.

- 10/20/10 insurance recommended to satisfy financial responsibility.

- Kentucky

- Is Motorcycle Insurance Required in Kentucky? Yes.

- Motorcycle Insurance Requirements in Kentucky: 25/50/25.

- Louisiana

- Is Motorcycle Insurance Required in Louisiana? Yes.

- Motorcycle Insurance Requirements in Louisiana: 15/30/25.

- Maryland

- Is Motorcycle Insurance Required in Maryland? Yes.

- Motorcycle Insurance Requirements in Maryland: 30/60/15.

- Mississippi

- Is Motorcycle Insurance Required in Mississippi? Yes.

- Motorcycle Insurance Requirements in Mississippi: 25/50/10.

- North Carolina

- Is Motorcycle Insurance Required in North Carolina? Yes.

- Motorcycle Insurance Requirements in North Carolina: 25/50/25.

- South Carolina

- Is Motorcycle Insurance Required in South Carolina? Yes.

- Motorcycle Insurance Requirements in South Carolina: 25/50/25.

- Tennessee

- Is Motorcycle Insurance Required in Tennessee? Yes.

- Motorcycle Insurance Requirements in Tennessee: 25/50/15.

- Texas

- Is Motorcycle Insurance Required in Texas? Yes.

- Motorcycle Insurance Requirements in Texas: 30/60/25.

- Virginia

- Is Motorcycle Insurance Required in Virginia? Yes.

- Motorcycle Insurance Requirements in Virginia: 30/60/20.

- Washington, D.C.

- Is Motorcycle Insurance Required in Washington, D.C.? Yes.

- Motorcycle Insurance Requirements in the District of Columbia: 25/50/10.

- West Virginia

- Is Motorcycle Insurance Required in West Virginia? Yes.

- Motorcycle Insurance Requirements in West Virginia: 25/50/25.

Western Region

- Alaska

- Is Motorcycle Insurance Required in Alaska? Yes.

- Motorcycle Insurance Requirements in Alaska: 50/100/25.

- Arizona

- Is Motorcycle Insurance Required in Arizona? Yes.

- Motorcycle Insurance Requirements in Arizona: 25/50/15.

- California

- Is Motorcycle Insurance Required in California? Yes.

- Motorcycle Insurance Requirements in California: 15/30/5.

- Colorado

- Is Motorcycle Insurance Required in Colorado? Yes.

- Motorcycle Insurance Requirements in Colorado: 25/50/15.

- Hawaii

- Is Motorcycle Insurance Required in Hawaii? Yes.

- Motorcycle Insurance Requirements in Hawaii: 20/40/10.

- Idaho

- Is Motorcycle Insurance Required in Idaho? Yes.

- Motorcycle Insurance Requirements in Idaho: 25/50/15.

- Montana

- Is Motorcycle Insurance Required in Montana? No.

- Motorcycle Insurance Requirements in Montana: None required, but the state recommends 25/50/20.

- Nevada

- Is Motorcycle Insurance Required in Nevada? Yes.

- Motorcycle Insurance Requirements in Nevada: 25/50/20.

- New Mexico

- Is Motorcycle Insurance Required in New Mexico? Yes.

- Motorcycle Insurance Requirements in New Mexico: 25/50/10.

- Oregon

- Is Motorcycle Insurance Required in Oregon? Yes.

- Motorcycle Insurance Requirements in Oregon: 25/50/20.

- Utah

- Is Motorcycle Insurance Required in Utah? Yes.

- Motorcycle Insurance Requirements in Utah: 25/65/15.

- Washington

- Is Motorcycle Insurance Required in Washington? No.

- Motorcycle Insurance Requirements in Washington: None, but the state recommends 25/50/10.

- Wyoming

- Is Motorcycle Insurance Required in Wyoming? Yes.

- Motorcycle Insurance Requirements in Wyoming: 25/50/20.

Tips for Finding The Best Motorcycle Insurance

Now that you know the motorcycle insurance requirements in your state, you want to find the best insurance for your money. Here are a few tips to use to find a policy:

- Compare quotes: Getting quotes from a few insurance companies is the only way to know you’re getting the best deal.

- Review coverage options: Carefully review quotes to ensure they are for the same coverage and amount of insurance.

- Discounts and savings: Insuring your motorcycle with the same company that insures your home or car may save you money. You also save by increasing deductibles, which is the money you pay out-of-pocket when you file a claim. Some companies offer discounts for veterans or senior citizens.

- Customer service and reputation: Read online reviews of insurance companies to ensure the one you choose has a good reputation for customer service. Here is an excellent source to learn how to choose a motorcycle insurance insurance policy and company.

Following these tips can take the guesswork out of meeting the motorcycle insurance requirements of your state without overpaying for the policy.

Conclusion

Complying with state motorcycle insurance requirements is essential to avoid penalties that may include fines and license suspensions. It also gives you peace of mind knowing you have insurance to pay claims made against you after an accident.

If you are injured in a motorcycle crash, you can recover compensation from the person at fault for causing it. Protect yourself by contacting the Motorcycle Legal Foundation for a personal injury attorney capable of aggressively fighting to get you the compensation you deserve. Contact the MLF today for a consultation.

Need Motorcycle Insurance?

Enjoy your ride while feeling safe with the best insurance coverage.