Much like insuring any other vehicle, insuring a motorcycle costs more when you’re less than 25 years old. If you’re 18 years old, you can expect the cost of insurance to be significantly higher than it would for an older adult.

The average motorcycle insurance cost for an 18-year-old is $998 per year. However, there are several variables that can raise or lower this amount by as much as $700. These factors include your home state, your driving record, and the type of bike you’re riding.

Let’s take a closer look at these costs, the factors that affect them, and how you can save money on motorcycle insurance.

How Much Does Motorcycle Insurance Cost?

The two most important factors in motorcycle insurance costs are your age and location. There’s nothing you can do about your age except continue living for a while. There’s also not much you can do about your location because, let’s get real, you’re not going to move just to get cheaper motorcycle insurance, are you?

We’ve found that among major cities, the motorcycle insurance cost for an 18 year old per month can range from $57.08 in Chicago to $111.58 in Los Angeles. In New York, the rate worked out to $87.50.

To put that in perspective, the annual rate worked out to $685 a year in Chicago, $1,050 in New York, and $1,339 in Los Angeles. That’s a variation of $654 per year, based on location alone.

For information on insurance cost, that’s non-specific to 18-year-olds, click here.

Why Are Motorcycle Insurance Costs so High?

So, why the high price? This will depend on a variety of factors. We’ve put together several of them, so you can better understand what goes into understanding your motorcycle insurance costs.

COVERAGE SELECTION

One factor is the type of coverage you purchase. 49 states require a bare minimum for liability coverage. This will get you a cheaper policy, but it will only cover damage to other vehicles or pedestrians. It won’t cover any damage to your bike. To get coverage for your bike, you’ll need collision and comprehensive coverage, which can cost significantly more. Some companies, like Progressive, offer extra plans like higher injury coverage for bikers.

Another coverage option that affects your rate is your deductible. This is the out-of-pocket cost you’ll pay in the event of an accident. The higher the deductible, the lower your rate. Then again, a higher deductible means you’ll be on the hook for more money if you get in an accident

LOCATION

As we already mentioned, your location can have a significant effect on your rate. The most important factor here is the temperature. In colder states, the riding season is shorter, while it can last all year in warmer areas. If you look at the numbers above, you’ll notice that Chicago motorcycle insurance costs less than half of what it does in LA. This is partially why.

AGE AND RIDING EXPERIENCE

There’s no question that your age is a major factor in determining your rate. Generally, your rates will get lower as you get older, at least until you’re in your 70s. But riding experience also matters. For example, a 50-year-old first-time biker will pay more for insurance than a 24-year-old with 6 years of clean biking experience

VEHICLE USAGE

Depending on how much you ride, your rates can vary significantly. Most insurers will ask you whether you’re riding for pleasure, or whether you’re using your bike as a commuter. Pleasure riders will pay much less than commuters.

Some insurers will also ask about your annual mileage. This can also have an effect on your rates. The more you ride, the more you pay.

SPEEDING AND TRAFFIC TICKETS

Just as with car insurance, your motorcycle insurance will go up if you have a record of speeding and other violations. The more violations you have, and the more severe they are, the more you’re going to pay. Thankfully, in most states, most violations fall off your record after 3 years. Keep your nose clean for a while, and your rates will go down.

Need information on state-by-state motorcycle laws? Click here.

ACCIDENT AND CLAIM HISTORY

If you’ve recently been in an accident, your insurance rates will go up. At-fault accidents will have the highest impact, while not-at-fault accidents will have less impact. No-fault claims will fall somewhere in the middle. Non-accident-related insurance claims can also raise your rate, but to a lesser extent.

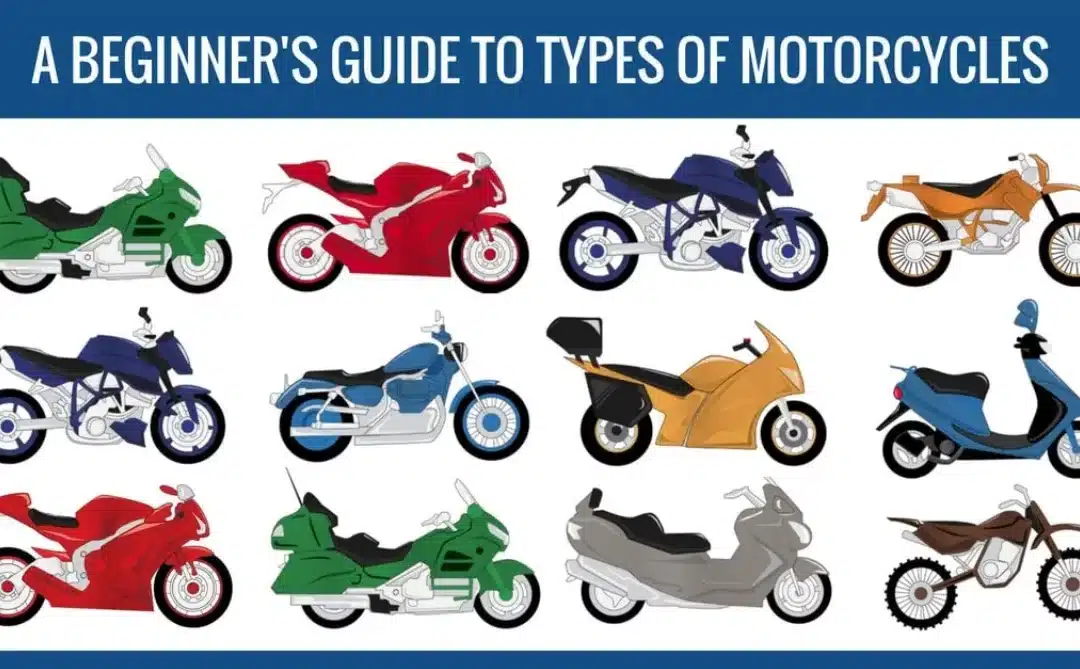

TYPE OF BIKE

The type and displacement of your bike will also affect your rates. For example, a 650cc cruiser will be cheaper to insure than a 650cc sportbike. Similarly, the 650cc sportbike will cost less to insure than a 900cc sportbike.

CREDIT

Most insurers run a credit check as part of providing a quote. A good credit rating will get you lower rates than a bad credit rating. And an insurance quote won’t count as a “hard check”, so it won’t affect your credit score.

Need Motorcycle Insurance?

Enjoy your ride while feeling safe with the best insurance coverage.

How to Save on Motorcycle Insurance

The most important thing to do when getting motorcycle insurance is to compare rates from different companies. Different insurers have different criteria, so your rates can vary considerably from one to the other.

Most insurance companies offer a variety of discounts. The most common discount is for getting a motorcycle endorsement on your driver’s license. Depending on the insurer, you can also save money by bundling your motorcycle insurance with a relative’s policy, taking a motorcycle safety course, or joining a school-affiliated motorcycle club.

Moped and Scooter Insurance

For a more comprehensive overview of motorcycle insurance, visit our Motorcycle Insurance Guide for 2020